Reinforce Your Heritage With Expert Trust Fund Structure Solutions

Specialist trust fund structure remedies use a durable structure that can protect your possessions and ensure your wishes are lugged out specifically as meant. As we delve into the subtleties of trust fund structure services, we uncover the key components that can strengthen your legacy and provide a lasting influence for generations to come.

Advantages of Count On Foundation Solutions

Trust fund structure services offer a durable framework for safeguarding possessions and ensuring lasting monetary safety and security for people and organizations alike. Among the main benefits of trust fund foundation options is asset defense. By establishing a trust, people can protect their properties from prospective threats such as claims, creditors, or unanticipated financial commitments. This protection makes certain that the possessions held within the trust fund stay safe and secure and can be passed on to future generations according to the person's wishes.

Additionally, depend on foundation services supply a critical technique to estate planning. Via trusts, individuals can describe how their properties need to be taken care of and distributed upon their passing. This not just helps to stay clear of conflicts amongst recipients however also makes certain that the person's tradition is managed and managed successfully. Counts on additionally supply personal privacy benefits, as possessions held within a depend on are exempt to probate, which is a public and often lengthy legal process.

Kinds Of Counts On for Legacy Preparation

When taking into consideration heritage preparation, a critical element includes exploring various types of lawful tools developed to preserve and disperse possessions efficiently. One common kind of trust utilized in tradition planning is a revocable living trust. This trust fund enables individuals to preserve control over their properties during their lifetime while making certain a smooth shift of these assets to recipients upon their death, avoiding the probate procedure and supplying privacy to the family members.

Charitable depends on are also popular for people looking to sustain a cause while preserving a stream of revenue for themselves or their beneficiaries. Special needs trust funds are important for people with disabilities to ensure they get essential treatment and support without endangering government advantages.

Understanding the different types of depends on readily available for legacy planning is important in creating an extensive method that aligns with individual goals and top priorities.

Picking the Right Trustee

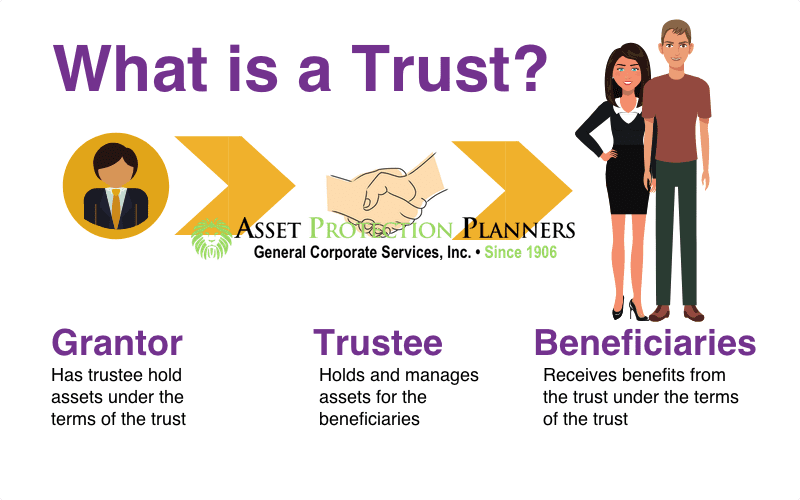

In the world of legacy planning, an important facet that requires mindful factor to consider is the selection of a suitable individual to satisfy the critical duty of trustee. Choosing the right trustee is a decision that can significantly impact the successful execution of a trust and the fulfillment of the grantor's dreams. When choosing a trustee, it is necessary to focus on high qualities such as dependability, monetary acumen, integrity, and a commitment to acting in the very best interests of the recipients.

Ideally, the picked trustee must have a solid understanding of monetary issues, be capable of making sound investment choices, and have the ability to navigate complicated lawful and tax obligation requirements. By very carefully taking into consideration these elements and choosing a trustee who aligns with the values and goals of the trust fund, you can help guarantee the long-lasting success and conservation of your tradition.

Tax Obligation Effects and Benefits

Thinking about the click for more info monetary landscape bordering trust structures and estate planning, it is critical to explore the elaborate realm of tax ramifications and benefits - trust foundations. When establishing a depend on, recognizing the tax obligation effects is critical for optimizing the benefits and reducing prospective obligations. Counts on provide different tax advantages depending on their framework and objective, such as minimizing inheritance tax, income taxes, and gift taxes

One significant advantage of particular depend on frameworks is the capacity to move possessions to beneficiaries with reduced tax obligation effects. As an example, this irreversible counts on can eliminate possessions from the grantor's estate, potentially decreasing inheritance tax obligation. Furthermore, some counts on allow for revenue to be distributed to recipients, that may remain in lower tax obligation braces, leading to overall tax obligation cost savings for the family.

Nonetheless, it is essential to note that tax obligation laws are intricate and subject to transform, highlighting the necessity of talking to tax specialists and estate planning specialists to guarantee conformity and make the most of the tax obligation benefits of trust fund foundations. Effectively navigating the tax obligation implications of depends on can lead to considerable savings and an extra his explanation effective transfer of wide range to future generations.

Steps to Developing a Trust

To develop a trust fund effectively, thorough attention to detail and adherence to lawful procedures are important. The initial step in establishing a depend on is to plainly define the function of the depend on and the properties that will be consisted of. This involves identifying the recipients that will certainly take advantage of the count on and selecting a reliable trustee to take care of the assets. Next off, it is crucial to choose the type of count on that finest straightens with your objectives, whether it be a revocable trust, irrevocable count on, or living depend on.

Conclusion

To conclude, developing a trust fund structure can offer numerous advantages for tradition planning, consisting of possession security, control over distribution, and tax benefits. By choosing the suitable kind of trust fund and trustee, individuals can safeguard their properties and ensure their wishes are performed according to their wishes. Recognizing the tax obligation implications and taking the essential actions to establish a trust fund can assist strengthen your heritage for future generations.